Shugam, Trusted Business License Provider

Apply Gst Return Filling

Apply Now for Gst Return Filling Online with the Help of Shugam Expert. Get It Quickly with us.

- Comprehensive Range of Services

- Say Goodbye to Lengthy Paperwork

- Personal Account Manager Support

- 10,000+ Licenses Delivered

- Fully Digital Process

- Cost-Effective Solutions

GST RETURN FILLING| A Must-Know for Businesses

GST return filing is a crucial compliance process under the Goods and Services Tax (GST) regime in India. Every registered taxpayer, including businesses, traders, and service providers, is required to file GST returns periodically to declare the details of their sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). The process ensures transparency between the government and taxpayers while maintaining a proper record of tax liabilities and credits. Timely and accurate GST return filing is essential not only to avoid penalties and legal issues but also to ensure smooth input tax credit claims.

There are various types of GST returns that need to be filed depending on the nature of the business. For instance, GSTR-1 is filed for outward supplies, GSTR-3B for summary returns, GSTR-4 for composition dealers, and GSTR-9 for annual returns. Each return has a specific due date, and non-compliance can lead to hefty fines and even suspension of the GSTIN (Goods and Services Tax Identification Number). Businesses must maintain all necessary documents such as invoices, debit/credit notes, and purchase records to file their GST returns accurately.

What is GST Return Filing?

GST return filing is the submission of business income and tax data to the government. It includes sales, purchases, tax collected (output), and tax paid (input).

Important Points:

A GST return must be filed by all registered businesses.

It helps in claiming Input Tax Credit (ITC).

Returns must be filed monthly, quarterly, or annually.

Different types of returns apply to different types of taxpayers.

Common Return Types:

GSTR-1 – Monthly return for sales

GSTR-3B – Monthly summary of tax

GSTR-4 – For composition scheme dealers

GSTR-9 – Annual return

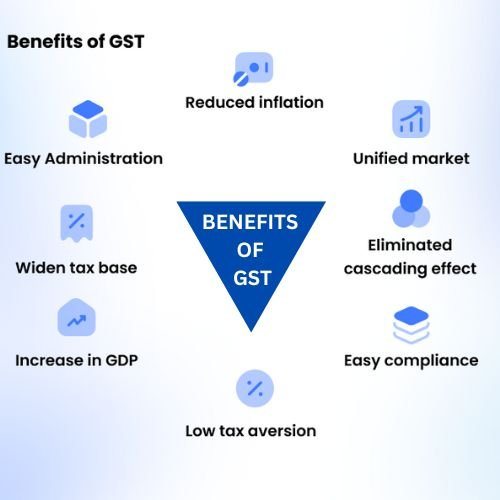

Benefits of Timely GST Return Filing

Timely filing brings not only compliance but also business advantages.

Key Benefits:

1- Claim full Input Tax Credit on purchases.

2- Avoid penalties, interest, and late fees.

3- Keep your GST number active and valid.

4- Maintain trust and credibility with clients and vendors.

5- Qualify for government contracts and tenders.

GST RETURN FILLING-ITC

One of the key benefits of GST return filing is the seamless flow of Input Tax Credit (ITC). Proper filing ensures that businesses can claim ITC on their purchases and reduce their overall tax burden. It also helps in reconciling data with suppliers and customers, making accounting and financial reporting more accurate. Moreover, staying compliant with GST norms helps businesses participate in government tenders, secure business licenses, and expand operations across states without legal hassles.