Shugam, Trusted Business License Provider

Apply Home Loan

Apply Now for Home Loan Online with the Help of Shugam Expert. Get It Quickly with us.

- Comprehensive Range of Services

- Say Goodbye to Lengthy Paperwork

- Personal Account Manager Support

- 10,000+ Licenses Delivered

- Fully Digital Process

- Cost-Effective Solutions

Home Loan –Your Dream Home

A home loan is a financial product that helps individuals purchase their dream home without the immediate burden of paying the full amount upfront. With flexible repayment options and competitive interest rates, home loans have become an essential tool for aspiring homeowners. Whether you are buying a new property, constructing a house, or renovating an existing one, home loans provide the financial support you need.

Who Needs a Home Loan in India?

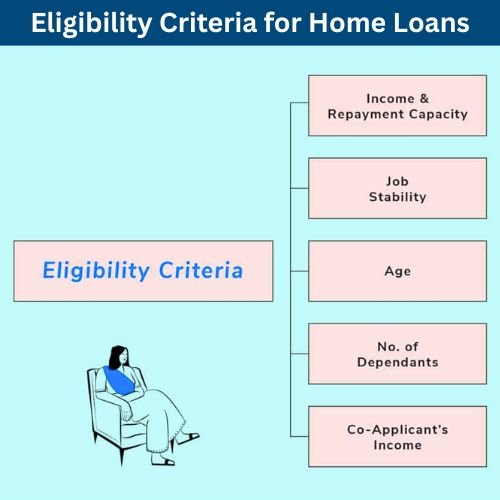

Eligibility Criteria for Home Loans

To qualify for a home loan in India, applicants generally need to meet the following conditions:

- Age: 21 to 65 years.

- Income: Minimum ₹25,000 monthly (varies by lender).

- Employment: Salaried, self-employed, or business owner.

- Credit Score: Preferably 750+ for better loan terms.

- Property Type: Residential property with clear legal title.

Documents Required for Home Loan Application

- Identity Proof: Aadhaar Card, PAN Card, Passport.

- Address Proof: Utility bills, Voter ID.

- Income Proof:

- Salaried: Salary slips, Form 16, bank statements.

- Self-Employed: Income Tax Returns (ITR), business registration.

- Property Documents: Sale Agreement, Approved Building Plan.

Why They Need It:

Higher loan eligibility due to combined income.

Shared EMI payments reduce individual financial stress.

Additional tax benefits when both applicants are co-owners.

📌 Why Is a Home Loan Important?

✔ Affordable Homeownership

Home loans make it easier to purchase a house by spreading payments over several years, reducing the need for large, upfront capital.

✔ Tax Benefits

Home loan borrowers can claim deductions on both principal and interest components under the Income Tax Act:

Section 80C: Up to ₹1.5 lakh on principal repayment.

Section 24(b): Up to ₹2 lakh on interest repayment.

✔ Financial Flexibility

A home loan provides immediate funds while allowing you to preserve your savings for emergencies and other investments.

✔ Capital Appreciation

Property values generally increase over time, offering long-term financial growth while paying EMIs.

Why Choose a Home Loan Expert In India?

Choosing a home loan expert can make the complex process of securing a home loan simple, efficient, and stress-free. Home loan experts offer personalized guidance and professional insights, ensuring you find the best loan options tailored to your financial needs. With their in-depth knowledge of lender policies, interest rates, and eligibility criteria, they help you navigate the complexities of the loan application process smoothly.

A home loan expert assesses your financial profile, recommends the most suitable loan products, and ensures you receive competitive interest rates and favorable terms. They also assist with preparing and verifying documents, minimizing errors that could delay approval. Their expertise helps you save time by handling negotiations with multiple banks and financial institutions, securing the best possible deal.

Moreover, home loan experts provide ongoing support from application to disbursal, keeping you informed and updated throughout the process. This ensures quicker approvals and a hassle-free experience. Whether you’re a first-time homebuyer, looking to refinance, or planning property investments, a home loan expert offers customized solutions to meet your goals.

Partnering with a trusted home loan expert can save you both time and money while simplifying your journey to homeownership. ✅ Get expert assistance today and secure your dream home effortlessly!